Family Caregiver Connection

Helpful tips for family caregivers

March/April 2011

Learn tips to ease the pain on several fronts.

Coping with another person's pain

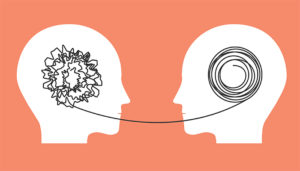

When your family member is in pain, you are suffering too. The “mirror neurons” in our brains are programmed to recognize pain in others. That’s good news, in that it arouses compassion and spurs us to action. But it can be bad news, too. When you’re highly attuned to a loved one’s pain, you’re at higher risk of depression and self-neglect.

When your family member is in pain, you are suffering too. The “mirror neurons” in our brains are programmed to recognize pain in others. That’s good news, in that it arouses compassion and spurs us to action. But it can be bad news, too. When you’re highly attuned to a loved one’s pain, you’re at higher risk of depression and self-neglect.

Learn about pain management. Your ability to reduce your relative’s experience of pain will help both of you.

- Report symptoms and ask questions. Download a pain tracking kit or app. And ask the doctor for a consult with a palliative care specialist. They have special training in pain control.

- Learn about medications. Master the steps you can take to lessen pain when it occurs.

Accept what is beyond your power and focus on what you can control.

- Emphasize comfort. Remind yourself, “Today, I may not be able to stop the pain, but I can still [prepare food, massage feet, etc.].”

- Provide distractions. If your family member is engaged in an activity, he or she is less likely to be aware of the pain.

- Take a time out. Be stress free for a while. Do something fun. Guilt is not productive. Being in emotional or physical pain yourself is not going to make your loved one feel any better. When you as the caregiver are refreshed, however, everyone benefits.

- Complete a project. Counteract your feelings of powerlessness by accomplishing something. Think small and simple. Clean out a drawer or bake a batch of cookies.

- Tap in to your spiritual/religious beliefs. Make time for prayer or meditation. Listen to a talk on the radio. Read an inspirational book.

Is your family member a hoarder?

We all accumulate belongings over the years. But when is it too much?

According to Michael Tompkins, PhD, author of Digging Out: Helping Your Loved One Manage Clutter, Hoarding and Compulsive Acquiring, your family member may be in the early stages of hoarding if he or she

- keeps parts of the home off limits and the curtains drawn;

- talks with you endlessly about the stuff. You’ve stated your concerns, offered help, even gotten angry, and yet there’s no action;

- gets overwhelmed decluttering even a small area. It becomes a major job that can take more than a few hours or days;

- often fails to pay bills. Not necessarily for lack of money, but because the bills can’t be located. Or the stamps. Or the checkbook;

- is in debt because of compulsive shopping;

- has trouble finding things and resists storing belongings out of sight;

- puts off home repairs. He or she may not recognize the need. Or may not want to let a repairperson see the house;

- insists on meeting you at your home. This avoids embarrassment or confrontation about the clutter;

- rents one or more storage units. There is a seemingly unquenchable need for more storage space;

- will not let you touch or borrow his or her possessions. Possessions are guarded fiercely and may be treated as if they are “friends.”

If these symptoms look familiar, your family member may well have a hoarding disorder. He or she literally lacks the ability to eliminate clutter. Suggestions for next steps:

- Don’t rush to action. Force will only alienate your loved one. By maintaining your relationship, however, you may be able to help manage the problem.

- Learn more. The most extensive studies on hoarding are done by scientists researching obsessive-compulsive disorder.

- Consider professional help. Especially if there are safety risks. Consider a care manager or in extreme cases, Adult Protective Services.

Tax breaks for family caregivers

If you are providing support to an aging family member, do some homework before filing your tax return.

You may be entitled to claim your relative as a dependent. This requires that:

- The individual’s income was less than $3,650 in 2010. “Income” includes Social Security and pension benefits. Also, proceeds from investments or withdrawals from retirement savings plans.

- You paid more than 50% of your relative’s support. He or she does not have to live with you. Support expenses include food, clothing, housing, and medical care. Also, transportation, recreation, and other essentials. If he or she lived with you, include fair rental value for your family member’s share of the lodging.

Many relatives qualify. Your parents and siblings. Other family relatives, step relatives, and in-laws. Or anyone who lived with you all year.

If others paid some support expenses, a deduction is still possible. But only one person can claim it. And everyone who shared expenses must sign a multiple support agreement.

You may be able to deduct medical expenses.

- This includes expenses paid for yourself, your spouse, or a dependent relative. Or for a relative who would have qualified as a dependent but had too much income or filed a joint return.

- The expenses must add to more than 7.5% of your adjusted gross income (AGI). For example, if your AGI is $40,000, the first $3,000 of expenses doesn’t count.

Look closely at what is considered medical expense. Some examples:

- Home improvements, such as grab bars and ramps

- Glasses, dental care, hearing aids

- Doctor’s fees, lab fees, prescription drugs

- Insurance premiums, including Medicare

- Care facility or nursing home fees (if residency is the result of medical need)

- Personal care for disability or cognitive impairment

- Car mileage related to medical care (16.5 cents/mile)

Ask a tax specialist for more details.

Return to top